- An introduction to Micro-and-Macroeconomics, based on the concepts of free enterprise and limited constitutional government. The topic of U.S. Government is integrated throughout the course, and we will be analyzing the Declaration of Independence, Constitution, and Bill of Rights as founding documents.

- Textbook: We will be using OpenStax Principles of Economics. This book is available as a free download, or in print on Amazon. I will also be linking to the Declaration of Independence, Bill of Rights, and the U.S. Constitution when we get there.

- Supplies: You will need a calculator Amazon link, and various types of graph paper throughout the course Printfreegraphpaper.com.

- You will need access to a relatively modern computer with internet connection. A computer less than 5 years old should suffice. You will need a webcam and mike to participate in the class.

- Homework: You'll be turning in your homework on Canvas.

| graph_paper_10ths.pdf | |

| File Size: | 13 kb |

| File Type: | |

| economics_-_investment_game_2022-23.docx | |

| File Size: | 5089 kb |

| File Type: | docx |

en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)

https://www.usgovernmentspending.com/year_spending_2022CAbn_25bs2n#usgs302

https://www.usgovernmentspending.com/year_spending_2022CAbn_25bs2n#usgs302

U.S. Revenue: https://www.usgovernmentrevenue.com/

U.S. Spending: https://www.usgovernmentspending.com/federal_budget_detail_fy24

U.S. Spending: https://www.usgovernmentspending.com/federal_budget_detail_fy24

California revenue: https://www.usgovernmentrevenue.com/year_revenue_2022CAbn_25bs1n#usgs302

California spending: https://www.usgovernmentspending.com/year_spending_2022CAbn_25bs2n#usgs302

California spending: https://www.usgovernmentspending.com/year_spending_2022CAbn_25bs2n#usgs302

The Role of Markets

Ch. 1: Introduction

|

Reading

Ch. 1 Lab

"Auctioning-off Dollars" - A classroom experiment in sunk costs and marginal costs

Ch. 1 Section Review questions

Instructions: Complete 'Section Reviews' 1A, 1B, and 1C. This is (10) questions total. Be sure to type out the questions in addition to your answers, and keep the same numbering system as the book. Upload to Canvas when finished.

| |||||||||||||||||||

Ch. 2: Choice and Scarcity

|

Reading

Ch. 2 Topics Production Possibilities Curve Begin discussing U.S. Budget Labs "World Oil Supremacy" - a classroom experiment on cartels and human behavior "Investment Game" - a classroom simulation in stock & bond portfolio allocation

Supply & Demand: If consumers were persuaded by Chick-fil-A to eat more chicken and less beef, would the cattle population increase or decrease short-term? What about long-term?

Ch. 2 Review Questions

Instructions: Complete Section Review 2A (3 questions), Section Review 2B (4 questions), and the "Application Questions" (3 questions). This is (10) questions total. Be sure to type out the questions in addition to your answers, and keep the same numbering system as the book. Upload to Canvas when finished. Other homework on Canvas

| |||||||

The Role of Markets

Ch. 3: Demand and Supply

Reading

Ch. 3 Topics

Homework Your chapter assignment is hosted in Canvas Labs

Be prepared to critique the video below using economics principles we have learned so far

| |||||||||||||||||||

Ch. 4: Labor and Financial Markets

Reading

Ch. 4 Topics

Homework Your chapter assignment is hosted in Canvas All of this leads us to a discussion of Comparative Government

World Oil Supremacy classroom experiment

This is a "supply" simulation. It's dealing with the question, "How should we handle the supply problem?" Lessons: Cartels always break down, due to 'defectors'. People will always seek their own self-interest. Any system which is based on people's "altruism" is doomed to fail. A system based on "Fairness and Guilt" doesn't work because people will seek their own self-interest. A Dictator tends to keep all the profits, or at best re-allocates them in order to get 're-elected'. A free market system using supply & demand curves tends to benefit suppliers and consumers and guarantees a steady supply. This is an example of Adam Smith's Invisible Hand.

| |||||||||||||

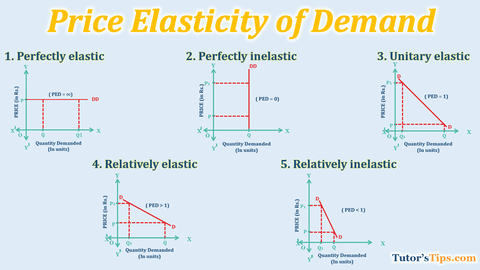

Ch. 5: Elasticity

Reading

Ch. 5 Topics

Homework Your chapter assignment is hosted in Canvas

| |||||||||||||

Economics of the Nation (2024 note: re-allocate old Units 5&6 under new textbook "Macro")

Unit 5: What is the economic problem? (re-allocate 5&6 for new textbook)

|

Reading

BJU Economics, Ch. 5 Outline What are our National economic goals?

Communism assignment

Now we will start discussing and comparing 'forms of Government' as it relates to Economics. In this case study we will look at Communism as it existed in the Soviet Union. You will watch part of a documentary and answer some questions. Access "The Soviet Story" video on Rumble and/or YouTube:

Chocolate Jalapeno business P&L statement

We'll start learning how to read a P&L

| |||||||||||||||||||

Unit 6: Economic Systems (re-allocate 5&6 for new textbook)

|

Reading

BJU Economics Ch. 6 Outline Any discussion of economics must include a discussion of Government.

Now we'll look at Capitalism: "Capitalism" arose from the writings of Adam Smith's "Wealth of Nations". The idea of Capitalism is that in order for citizens to enjoy economic and political liberty, they must strictly limit their government to three major duties.

The word "Capitalism" just means you can raise your own capital. You don't have to go to the King or Dictator to raise money. You, yourself, can go directly to banks, private individuals, your friends, your parents, the stock market, or "crowd-funding" to finance your enterprise. Those supplying you with capital are then entitled to receive a return on their investment.

With Capitalism, individuals own stock in companies. They have real ownership in the Factors of Production. Even a poor person can own a small portion of a business enterprise. Almost all large corporations in America are in effect owned by multitudes of average, ordinary citizens. This is something Marx and Engels did not foresee. "Laissez Faire" is a famous term used in economics which means "leave us alone". It was the French telling their King, "Stop meddling in the economy, because you're wrecking it". Here's a quick summary of economic systems:

Common Property experiment

"A common property experiment with a renewable resource" Learning objectives: property rights, allocation of natural resources, negotiation, cooperation Discussion: "Tragedy of the Commons"

| |||||||

Economics of the Business Firm

Ch. 7: Production and Business Costs

Reading

Ch. 7 Production, Costs, and Industry Structure Topics

Additional topic

| |||||||

Classically, there are 3 forms of setting up a business

1. Sole proprietorship 2. Partnership 3. Corporation Sole Proprietorship

Partnership

Corporation

| |||||||||||||||||||

Ch. 8: Perfect Competition

Homework on Canvas

| |||||||

Ch. 9: Monopoly

Capitalism, Profits, and Justice assgmt

| |||||||||||||

Ch. 11: Monopoly and Antitrust Legislation

Reading

Ch. 11 Summary Types of Competition

Financing a Business class experiment "Financing a Business" simulation using a modified Monopoly platform. Objectives: How to finance several rounds of business operations, make decisions at the Board level, pay dividends or plough-back earnings, and manage a P&L statement

| |||||||||||||||||||

Ch. 14 Labor Markets and Income

|

Reading

Ch. 14

Dictators, Monarchs, and Presidents: Comparative Government, part 2:

You will watch part of the documentary below and answer some questions. Access the documentary on Rumble and/or YouTube:

| |||||||||||||

Ch. 17 Financial Markets

|

Reading

Ch. 17

Raising Capital for a Business

Broadly speaking, there are three (3) ways a corporation can raise capital to expand or carry out new projects:

Ch. 17 Review Questions

Hosted in Canvas Wealth, Greed, and Slavery assignment

The student example is posted for ideas. Do not copy it. I'm interested in your opinion.

| |||||||||||||||||||

Midterm Review

Economics of Government & Society

Ch. 19 & 20: Macroeconomics, GDP, and Growth

U.S. GDP Growth Rate 1961-2023. www.macrotrends.net. Retrieved 2023-03-01.

- All charts datacommons.org U.S. Economics and Labor charts

- U.S. CPI https://tradingeconomics.com/united-states/consumer-price-index-cpi

- U.S. Exports & Imports by category https://tradingeconomics.com/united-states/imports-by-category

|

Reading

Ch. 19 & 20 Summary The central question: "Why do some nations prosper, while others do not?" What nations need to prosper:

The role of institutions is also important:

Gross Domestic Product (GDP) is the most common measure of the nation's economic output. GDP = the total dollar value of...

GDP (Y) has four basic components

Therefore we say, Y = C + I + G + NX GDP does not account for

Homework End of chapter problems are on Canvas

| |||||||||||||

Ch. 21: Unemployment and The Business Cycle

|

Politicians use the economy as a weapon. This is a classic from then-candidate Ronald Reagan. But did President Carter cause the 1979-1981 recession? Discuss...

|

|

Reading

Ch. 21 Causes of the business cycle Here's 5 classic theories:

The unemployment rate

Total U.S. population

Review these links:

|

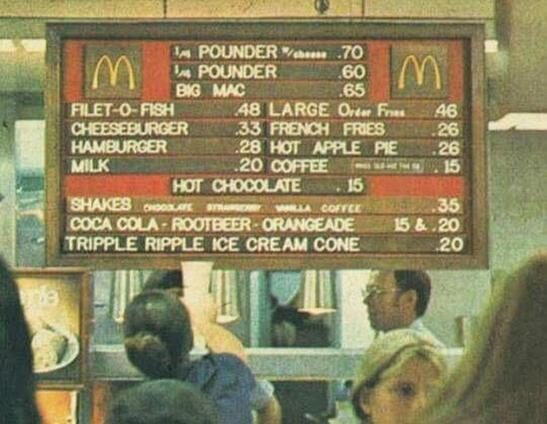

Ch. 22: Inflation

|

Reading

Ch. 22 Inflation

Causes of Inflation

Why would a Government want to cause inflation?

Homework

Chapter review problems are on Canvas

| |||||||||||||

Ch. 27: Money and Banking

|

Class preparation

Read Ch. 27 Lecture topics Functions of money

Money and Banking classroom exercise

Objectives: 1) Simulate a society without money, and demonstrate the problems that occur with trade, 2) Create a bank in the 16th Century and demonstrate how it gets started and how it functions, and 3) Simulate a 16th Century bank with "fractional reserve requirements" and demonstrate how the supply of money grows as a result. |

Ch. 28: Central Banking & Monetary Policy

|

Reading

Ch. 28 Lecture outline The central bank in the U.S. is called the "Federal Reserve System". It is often just called "The Fed". It is headquartered in Washington D.C. - see picture above. The Federal Reserve was created in 1913 by Congress and President Woodrow Wilson. The National Income Tax was instituted in the same year. They go hand-in-hand. These are two of the most important events in the U.S. in the 20th Century. Stated purpose of the Federal Reserve System: To regulate the nation's money supply and provide a favorable monetary climate that benefits the whole economy. Three major centers of decision-making

How the Fed controls the money supply

The Federal Reserve System is NOT part of the Federal Government. It is a PRIVATE - or public/private - bank. It is called "the bankers' bank". There is a lot of controversy over whether the Federal Reserve should be allowed to create the nation's money, or whether the U.S. Congress should create the nation's money as stipulated in the U.S. Constitution. This controversy is extremely worthwhile to explore and think about, but goes a little beyond the scope of this class. The U.S. Treasury Dept. is a part of the Federal Government. The purpose of the U.S. Treasury is to finance the government. The Treasury issues bonds and bills (known as "Treasuries", T-bills, government bonds, etc) to finance the shortfall between tax receipts and federal spending. In class we will talk about "who owns" the national debt, which is currently about $32 Trillion. To summarize, the U.S. Treasury borrows money to pay for federal spending. The U.S. government spends about $6 Trillion per year - but only collects about $4 Trillion in taxes - so it must borrow the other $2 Trillion each year. That is the job of the U.S. Treasury Dept. Classroom Activity "Central Bank" classroom experiment: Objectives: Create several banks with "fractional reserve requirements" and demonstrate how the supply of money can be expanded and contracted by adjusting reserve requirements. Homework End of chapter problems are on Canvas |

Ch. 30: Government Budgets & Fiscal Policy

|

|

|

|

Reading

Ch. 30 Lecture outline Fiscal Policy was developed by John Maynard Keynes in The General Theory of Employment, Interest, and Money (1936) Became known as "Keynesian Economics" Pronunciation: Keynes rhymes with Canes. Keynesian = Canes-ee-an

The National Budget You should have a general idea of the government's budget (taxing and spending).

Classical Economics had said that peaks and valleys in the economy will smooth themselves out if left alone to the private sector. Supply and demand would rise and fall, but always return to equilibrium due to market forces. Wages would rise and fall, but would always follow the laws of supply and demand. If demand falls, wages will fall... but then prices will also fall, leading to more demand, leading to more output, and thus leading back to higher wages.

In these ideas, you probably recognize the influence of Adam Smith in The Wealth of Nations (1776).

Keynesian Economics was a huge departure from this. Keynes said that government should take an active role in managing the economy. In times of economic recession, the government should spend more money to stimulate output and try to keep wages high. In times of economic prosperity, the government should raise tax rates, thus siphoning money out of the economy, thus decreasing demand, thus decreasing output. The money brought in by higher taxes would be "set aside" for a rainy day, so to speak. Thought questions:

From our 21st century perspective of big, overreaching government sticking its fingers into every aspect of our lives and running up massive amounts of debt, Keynes can seem out-of-touch. In truth, he was an extremely intelligent and well educated person with a wide range of views on many things. In the 1930's, people were living through the Great Depression and trying to figure out government's best role in responding to it. Also keep in mind that people like Keynes (1930's) were trying to combat Marxism-Communism, which they viewed as extremely dangerous. Class exercise: Analyze and compare the following quotations from Keynes (these are not related, they are from different periods of his life)

Today, if you say you are "Keynesian", it's a way of saying you favor a big, centralized government.

New-Classical Economics advocates limiting the government's role in the economy (and, by extension, in society). This view has been heavily influenced in the U.S. by economists such as Milton Friedman, Robert Lucas, and Thomas Sowell. You get the gist of economist Milton Friedman if you look at some of his quotations:

On having a work ethic:

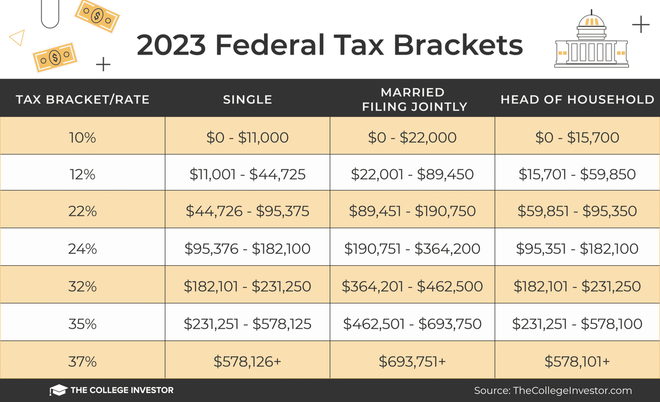

Taxation

In the U.S., we have a progressive income tax. Look carefully below at the rates. Class discussion:

Mr. & Mrs. Taxpayer assignment

Tax assignment hint: Their taxable income (line 10 on Form 1040) will be between $65,000-70,000, their tax owed (line 11) will be between $7,000-8,000, and the amount of their refund (line 20a) will be between $3,000-5,000.

Homework

End of chapter problems are on Canvas | |||||||||||||||||||

U.S. Government: Our Founding Documents

Declaration of Independence

|

Reading

You will need to read the Declaration of Independence From the National Archives: https://www.archives.gov/founding-docs/declaration-history The "Law of Nature and Nature's God" was a common expression used by Montesquieu, Blackstone, Locke, and Sidney Lecture outline

Homework

| |||||||

Unit 17: U.S. Constitution and the Separation of Powers

|

Reading

For this lesson you will need to read the Constitution. It isn't very long... (see link below) You will also need to read about the "setting" or "historical context" (see link below) The U.S. Constitution is here https://constitution.findlaw.com/articles.html The historical background is here https://www.whitehouse.gov/about-the-white-house/the-constitution/ An 'explanation' of the Constitution is here https://www.britannica.com/topic/Constitution-of-the-United-States-of-America

The U.S. Constitution contains two radical ideas:

Historical Context

The original 13 Colonies were ultimately governed by Great Britain through royal governors charted by the Crown. Americans considered themselves to have all the rights of Englishmen, even though they were separated by the vast Atlantic Ocean. One of these rights was that taxes could only be imposed by your representatives in British Parliament (not by the King himself). Americans were outraged when the British Parliament began imposing taxes on them in order to pay for defending them against Indian raids and French incursions (the long & expensive "French and Indian War" had just ended around 1763). Americans had no representation in Parliament, so how could Parliament lawfully impose taxes on them? The British government countered this argument by saying that Americans had "virtual representation" in Parliament.... this was because representatives who were elected by British voters actually represented all Englishmen, no matter where in the far-flung Empire they might be located! Revolt came in 1776, with the Declaration of Independence. During the Armed Revolution, the States cooperated with one another through the Continental Congress, a body of delegates from each of the Colonies. The Continental Congress would meet and decide how to conduct the War of Independence, and how to pay for it. With General Cornwallis' surrender in 1781, the Articles of Confederation were created to form a loose confederation of "United States". The Articles of Confederation stipulated that each State retained its own sovereignty, freedom, and independence. The United States Congress had the power to make war, but had no power to tax or regulate commerce in any way. Predictably, the Articles of Confederation did not work very well. All they did in essence was create a loose confederation of 13 independent nations. The different States gouged each other on trade and tariffs, the rates of exchange between their currencies constantly fluctuated and was almost impossible to track, and no one wanted to pay off the debts incurred to finance the Revolution. It could not continue...

By 1786, representatives from several large States resolved that a "General Convention" be held the following year in Philadelphia to address the problems. Thus, the Constitutional Convention took place in the summer of 1787. The delegates set about designing an entirely new charter of government, which was given the name, "U.S. Constitution". | |||||||||||||

Unit 18: Bill of Rights and Limits on Government Power

|

Reading

Read the Bill of Rights, posted below with notes that correspond to the lecture video.

The First Amendment: Case Brief

Choose a landmark 1st Amendment case (freedom of speech, press, religion, and assembly) that interests you, research it, and write a 2-page "brief" on the case, using 11-pt font and 1.15 spacing. Here is a good place to start searching: https://en.wikipedia.org/wiki/List_of_United_States_Supreme_Court_cases_involving_the_First_Amendment. There are lots and lots of very interesting 1st Amendment cases, covering all sorts of things! Find one that interests you. EXEMPLARS:

How to brief a case:

First Amendment - Campus Free Speech assignment

Freedom of Speech on college campuses is a hot issue right now! Some students say "offensive speech" is not "free speech".

The following video shows a student being arrested after attempting to limit someone else's freedom of speech.

The student was offended by a sign being displayed on campus. Listen carefully to the Free Speech argument given by the police officer. Background to the First Amendment:

The First Amendment guarantees the freedom of speech and religion.

Important! Notice that the First Amendment:

The Supreme Court has repeatedly ruled (as recently as 2017) that "hate speech" is legally protected free speech under the First Amendment. In other words, citizens can march down the street with some pretty offensive signage, as long as they are not inciting people to commit a crime.

As recently as 2017, in Matal vs. Tam, the U.S. Supreme Court affirmed that there is no "hate speech" exception to the First Amendment.

The Second Amendment: Case Brief

Choose a landmark 2nd Amendment case (right to bear arms), research it, and write a 2-page "brief" on the case, using 11-pt font and 1.15 spacing. Search "Second amendment landmark cases" and you will get many cases to choose from. A very recent landmark 2nd Amendment case is "District of Columbia v. Heller" (self-defense of the home), which would be an excellent example. Another recent case is Caetano v. Massachusetts. (defendant carried around a "stun gun"). EXEMPLARS:

The Fourteenth Amendment: Case Brief

Choose a landmark 14th Amendment case (right to privacy, due process, equal protection), research it, and write a 2-page "brief" on the case, using 11-pt font and 1.15 spacing. Landmark 14th Amendment cases would include Roe v. Wade (abortion), Obergefell v. Hodges (same-sex marriage), Brown v. Board of Education (segregation of schools), and Griswold v. Connecticut (created the "right to privacy"). Search "14th amendment landmark cases" and you will get many more.

Optional assignment: How the Second Amendment Prevents Tyranny

Write a 1-1/2 page summary of the article, "How the second amendment works to prevent tyranny", posted below, using 11-pt font and 1.15 spacing. In your analysis, specifically address: a) what are the arguments?, b) what is a "militia", c) what did Madison say in "Federalist #46"?, d) how would an armed populace protect against tyranny?. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||